The Russian Far East (RFE) constitutes both an asset and a liability for Russia. Stretching from east of Lake Baikal to the shores of the Pacific Ocean, this huge expanse of northeastern Eurasia contains all kinds of natural resources—oil and natural gas, coal, iron ore and copper, gold, diamonds, uranium, pristine freshwater, timber, and fish stocks. The RFE boasts 15,000 miles of Pacific coastline and controls the eastern reaches of the Arctic. The RFE also gives Russia direct access to the Pacific Ocean, which makes it a truly transcontinental nation spanning the Euro-Atlantic and the Asia-Pacific. At the same time, its location, remote from and with tenuous transportation links to the country’s core, as well as its underpopulation, underdevelopment, and the lack of basic infrastructure make the RFE a source of constant concern for Moscow. Since Russia acquired these lands, it has faced a recurring risk of losing control over them as a result of external aggression, foreign encroachment, internal separatism, or combination of all three.

Around 2007, Moscow initiated an array of measures and policies designed to significantly accelerate the development of the RFE. This task was proclaimed by the Kremlin “a national priority,” and featured large-scale state-funded investments, mostly in infrastructure projects. Heightened attention to the RFE was linked with Moscow’s broader strategic priorities such as the enhancement and expansion of economic cooperation with East Asia to take full advantage of the rise of Asian economies and diversify away from stagnating Europe. Yet, the results of the strategy to invigorate the RFE and advance economic interaction with Asia have been mixed. The RFE’s economic and social situation improved, compared to what it was a decade before, but it remains an economic backwater that accounts for only five to six percent of Russia’s gross domestic product (GDP) and about four percent of its population. The number of permanent residents continues to decline, mostly due to out-migration.

The herculean task of revitalizing the RFE grew much more difficult after the Kremlin’s attention and resources became distracted because of the Ukraine crisis and associated Western sanctions. Add to that the dramatic fall in oil prices, whose high levels had hitherto helped finance Moscow’s priority projects, including those in the RFE. That said, there are still reasons for cautious optimism regarding the RFE’s prospects.

A Far Eastern Viceroyalty?

Despite the deteriorating situation in Russia’s economy and external crises in Ukraine and Syria, the Putin administration still treats the RFE as a priority. This is reflected in special governance, regulatory and fiscal regimes that Moscow has been instituting for the region. In August 2013, Vladimir Putin appointed Yuri Trutnev, who previously served as minister for environment and natural resources and later as Putin’s aide, as the man in charge of affairs in the area. Concurrent with the position of presidential representative to the Far Eastern Federal District, Trutnev was given the rank of a deputy prime minister, reporting directly to the prime minister and president. The Far East became only the second region of Russia, after the North Caucasus, for which a deputy prime ministerial office was established. Trutnev was given expansive powers, becoming a de facto viceroy, overseeing nine provinces as well as the federal Ministry for the Development of the RFE. A Kremlin insider, he enjoys direct access to Putin with a reputation for being a tough guy and one of the most efficient officials in the Russian government.

Under Trutnev’s watch, a package of measures has been adopted to improve the RFE’s business climate and attract private investors. In December 2014, the federal law on special economic zones was passed that made it possible to designate areas in the Far East as “territories of accelerated development” (sometimes also translated into English as “territories of priority development”). Such territories will offer investors, both domestic and foreign, streamlined administrative procedures, lowered taxes, a privileged customs regime, and easier rules for hiring foreign labor. They will also get access to infrastructure, such as electricity and transportation, to be built at the government’s expense. So far nine “territories of accelerated development” have been inaugurated, even though investors have yet to start large-scale production on designated sites. Another landmark event was the designation of Vladivostok, Nakhodka, and their environs in the southern Primorsky Territory as a “free port.” The law on the “free port of Vladivostok” was adopted in July 2015, featuring benefits of regulatory liberalization similar to the “territories of advanced development.” Additionally, the free port was granted a very significant privilege of visa-on-arrival entry for foreign visitors (they can stay in Russia for up to eight days). A de facto free travel regime is a revolutionary move for Russia with its traditionally difficult and prohibitive visa regulations. Trutnev is now pushing for extending a free port regime to other ports in the RFE.

Being part of Russia’s national economy, the RFE was not spared the recession the country entered from 2014; however, the RFE’s basic performance indicators look slightly better compared to Russia’s average.1 As one reason, the region may be favored by the fact that most of its external economic links are with Asia, and thus are not as much affected by the European Union’s sanctions and Russia’s counter-sanctions that cause damage to the economy of the European part of Russia.

China’s Growing Interest in the RFE

The RFE historically has had an ambivalent relationship with its giant neighbor. Certainly, China is perceived as an indispensable economic partner—a provider of essential goods and services as well as a major consumer of the RFE’s staples. Yet, China has always simultaneously been perceived as a potential threat. After all, the southern part of what is now the RFE used to be under the nominal sovereignty of the Qing dynasty. Even though the border issue between Moscow and Beijing is considered fully settled by legal treaties, concerns linger in Russia that China might seek to reclaim these lands in the future.

China’s interests in the RFE combine economic and strategic imperatives. First and foremost, China needs the RFE as a proximate overland supplier of vital raw materials. Of course, China can get these resources elsewhere, but its geo-economic stake in the RFE is directly related to its intensifying contest with the United States for primacy in the Asia-Pacific. Beijing is increasingly worried that, if this rivalry comes to a head, Washington may use its trump card—launching a naval blockade of the sea lanes through which China receives most of its imported primary products.2 If anything, these concerns have increased in recent years and so has the priority that China attaches to the RFE as a secure and reliable source of some essential commodities.

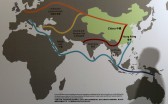

In the 1990s and 2000s, China’s economic presence in the RFE was mostly represented by the northeastern province of Heilongjiang and limited to primitive trade exchange—with little investment and few, if any, big Chinese players operating in the region. Yet, China’s economic footprint in the RFE and eastern Siberia has begun to grow quantitatively and qualitatively in recent years. Reflecting Beijing’s newfound interest in the RFE, Vice President Li Yuanchao called for the linking up of the RFE with northeast China to create “a single economic integration zone” and “a new economic bloc for Asia.”3 The RFE is highlighted in Beijing’s Silk Road blueprint, which claims to strengthen cooperation between China’s Heilongjiang, Jilin, and Liaoning provinces and Russia’s Far East.”4 For its part, in a significant departure from previous policies, Moscow has lifted informal restrictions on Chinese investments in the RFE and has begun to actively court Chinese capital.

Over recent years, a number of major Russian-Chinese projects, centered on the RFE, were announced. The largest of these deals was the signing of a USD 400 billion natural gas deal in May 2014 between Gazprom and the China National Petroleum Corporation (CNPC) that would supply northeast China with pipeline gas from fields in the RFE and eastern Siberia starting from 2019. Other recent Chinese investments in eastern Russia have targeted oil, copper, iron ore, coal mining, gold, forestry, ports, and electric power generation. In 2014, Russia and China also began construction of a railway bridge—the first permanent link between the two countries across the Amur River—which will connect the RFE’s hinterland and Heilongjiang province. Chinese companies have also become the principal investors in a large casino resort complex near Vladivostok, which was opened in November 2015. The complex primarily targets the millions of would-be gamblers in northeast China.

China’s economic slowdown that we are beginning to witness will not make the RFE less significant for the PRC. Even with the slowing economic growth, China will still remain a country of 1.4 billion people and will continue to demand huge volumes of natural resources and energy that need to be imported. The incipient change of priorities in Chinese economy and society in favor of quality of life, as opposed to sheer GDP growth, will make the RFE even more important to China in some respects. As one example, the extreme air pollution in northern areas of China, including Beijing, cannot be effectively tackled unless coal, its primary cause, is replaced with cleaner energy.5 The most realistic alternative is natural gas from the nearby RFE.

Another case in point is China’s growing appetite for imported foods. The RFE, with its uncontaminated land and rich fish stocks, can be an important component in China’s food security strategy.6 Chinese traders have shown increasing interest in importing various foodstuffs from the RFE, especially because they are considered more organic compared to Chinese-produced foods. The devaluation of the ruble makes Russia’s agricultural products even more attractive. Russia’s agribusiness corporations are planning to launch production of pork, soybeans, sugar, and seafood aquaculture in the RFE, specifically targeting China’s market. In December 2015, the Russo-Chinese Fund for Agriculture Development was established, which will focus on projects in the RFE, with most of the investments coming from Chinese sources.7

Japan and Korea: Alternatives to China?

Even though Russia and China are close “strategic partners,” and perhaps even quasi-allies, Russia is uncomfortable with becoming over dependent on China and shows obvious interest in promoting ties with two other Northeast Asian neighbors—Japan and South Korea. Apart from being geopolitical hedges against China, they are also valuable as sources of advanced technologies and expertise for the RFE—something that China still lacks.

Japan looks like the most obvious option as a regional counterweight to China. Some prominent Russian analysts suggest it could become “Russia’s Germany in the East,” a reliable source of technologies and capital.8 Japan is the Asia-Pacific country that shows the most alarm concerning the rise of China, and this alone should make it predisposed to take steps countervailing the growth of Chinese influence in the neighboring RFE. However, the dispute over the Kuril Islands/Northern Territories still poisons the bilateral relationship and stands in the way of expanding Russian-Japanese collaboration. Furthermore, even though Japan is still interested in the RFE’s natural resources, the stagnant Japanese economy makes Tokyo a less attractive partner. In particular, energy consumption in Japan is flat, which puts basic limitations on the prospects for Russian-Japanese energy cooperation. Finally, Tokyo’s alliance with Washington and its membership in the Group of Seven (G7) place restrictions on how far it can advance cooperation with Moscow, at least for the time being. That said, Prime Minister Abe Shinzo is eager to improve relations, which is being reciprocated by the Kremlin. He and Putin seem to have established rapport, and the two sides continue to quietly negotiate the territorial issue.

Like Japan, the Republic of Korea is important as a source of capital and modern technologies for the RFE as well as a major consumer of its primary products. It is also significant that, in contrast to Russian-Japanese or Russian-Chinese relationships, there is no negative historical legacy between Russia and Korea. As opposed to China, which is viewed as a strategic challenge by many in Russia, and unlike Japan with which Russia has an unresolved territorial dispute, Korea is not considered a geopolitical concern for the RFE, making it much easier for the two sides to cooperate in vital economic areas. The ties are assisted by the presence of a fairly large and active community of Russian-speaking ethnic Koreans in the RFE. There are also political motives why Seoul wants a strong presence in the RFE. This is viewed as a way of gaining additional leverage over North Korea, which borders the RFE and thus facilitating prospective reunification.

However, South Korea’s economy is relatively small—just one-fourth the size of Japan’s and one-seventh that of China. Also, like Japan’s, South Korea’s economic growth is slowing down, thus moderating the country’s demand for the RFE’s commodities exports. Additionally, South Korea, though not a G7 member and not theoretically required to join in anti-Russian sanctions, is allied with the United States. Hence, Seoul cannot but take into account the state of US-Russian relations in developing cooperation with Moscow. The absence in recent years of substantial Japanese and Korean business deals in the RFE indicates that Tokyo and Seoul are unlikely to compete with Beijing for economic influence in Russia’s eastern territories.

Conclusion

Even though the RFE is getting special treatment from Moscow, the region remains part and parcel of a huge country, which has the governance system generally characterized by low efficiency and incompetence. Unless the Russian state as a whole successfully modernizes its institutions, there will be no bright future for the RFE. Thus, the domestic factor— developments within Russia itself—will be most crucial.

On the external side, China will be by far the most important determinant of the RFE’s future trajectory. For various reasons—from geo-economics to environment to food security—China’s interest in the RFE is likely to grow. China’s tightening embrace of the RFE will provide the region with much needed cash infusions and give it access to one of the world’s biggest markets. Yet, such benefits will come with the significant risk of the RFE becoming China’s natural resource periphery.

1.“Vladimir Putin: The RFE Showed the Best Rates of Growth,” December 29, 2015, http://minvostokrazvitia.ru/press-center/news_minvostok/?ELEMENT_ID=3978.

2.Judging from the debate among US security specialists, economic strangulation of China by means of a naval blockade may be emerging as the optimal strategy for dealing with China in a major conflict. See, for example, Sean Mirski, “Stranglehold: The Context, Conduct and Consequences of an American Naval Blockade of China,” Journal of Strategic Studies 36, no. 3 (2013): 10-11. See also T. X. Hammes, “Offshore Control is the Answer,” US Naval Institute, December 2012, http://www.usni.org/magazines/proceedings/2012-12/offshore-control-answer.

3.“China’s Vice President: China Should Invest More in Russia,” ITAR-TASS, May 24, 2014, http://itar-tass.com/ekonomika/1212483.

4.National Development and Reform Commission, Ministry of Foreign Affairs, and Ministry of Commerce of the People’s Republic of China, “Vision and Actions on Jointly Building Silk Road Economic Belt and 21st-Century Maritime Silk Road,” March 2015,

http://en.ndrc.gov.cn/newsrelease/201503/t20150330_669367.html.

5.Zheng Jinran and Wang Yanfei, “Low-grade Coal is Cheaper, but Poses Pollution Challenge,” China Daily USA, December 21, 2015, http://usa.chinadaily.com.cn/epaper/2015-12/21/content_22763854.htm.

6.Zhang Hongzhou, “China is Marching West for Food,” RSIS Commentaries, February 4, 2014, www.rsis.edu.sg/rsis-publication/rsis/2148-china-is-marching-west-for-foo/#.VVqlg5PmUqM.

7.Interview with Minister for Far East Development Alexander Galushka, December 28, 2015, http://www.eastrussia.ru/material/dalnevostochnyy-trillion-i-dalnevostochnyy-gektar/.

8.Dmitri Trenin, interviewed by Kommersant, September 25, 2012, www.kommersant.ru/doc/2029312.