For 15 years from the moment of the signing of the Treaty of Good-neighborliness, Friendship, and Cooperation between Russia and China, noteworthy changes have occurred in this bilateral relationship. They have achieved significant success in strategic cooperation, notably in the field of security as their military-political and military-technical interactions have intensified. The two countries actively cooperate in efforts to forge alternative international political formats (the SCO, BRICS). However, at present the overall state of relations between the two is characterized by the formula “politics hot, economics cold.” Already for an extended time, this relationship has been distinguished by a significant gap between the level of political cooperation and the scale of cooperation in trade and mutual investment.

To be sure, in 2001-16, bilateral trade rose substantially, but it is still based on sectors of the “old economy” (energy and heavy industry). New directions of cooperation have been identified only in the most recent period, thanks mainly to structural change in the economy of China, where urban consumers are gradually becoming the new drivers of growth. Among these new directions are cross-border e-commerce, commercial production of the agro-industrial complex, tourism, development of financial infrastructure, and widened use of national currencies in settling mutual accounts. This has led to some shift in the structure of bilateral trade and gives hope that economic complementarity can develop not only in the energy sector, but also in such spheres as investment, science and technology, agriculture, transportation, and electroenergy.

The main contents, however, of the forces brought to bear of late from the Russian side remain the traditional ones in the resource sector of the economy, called upon to compensate for the reduction of export income in European markets. Among them are the biggest projects in the Russian Far East intended for establishing magisterial export infrastructure (oil and gas pipelines, rail approaches to seaports and port reconstruction, and new deposits of coal here and in Eastern Siberia). In this category I also put new institutional measures in support of inter-regional investment cooperation in the Far Eastern regions of Russia with the goal of broadening cooperation with China and attracting investment, including in innovation-heavy sectors.

Despite the importance of institutional innovations in the Russian Far East in pursuit of eliminating differences in the entrepreneurial climate and investment attractiveness between Russian and Chinese provinces, the bulk of Russo-Chinese economic cooperation is, as previously, determined by large state companies. The mainstay in bilateral cooperation are the traditional «magisterial megaprojects» in energy, the military-industrial complex, massive infrastructure construction, etc. The main participants in bilateral cooperation are big, mainly state, companies and the corresponding ministries and bureaus.1 On this level Russia and China have gained experience in cooperating, which facilitates warm relations between their leaders, simplifying the decision-making process at the highest level.2 Given the economic and political specifics of each country, cooperation at the highest political level and between major companies reaching concrete deals will most likely remain the basis of the bilateral partnership.

Bilateral economic dynamism, especially its impact on the economic development and financial well-being of the Russian Far East, to a significant degree depends on nurturing a large number of cooperating small and medium-sized firms in production and services. As a rule, the conditions for cooperation for these firms substantially differ from those in which contacts between big companies have developed. Despite efforts to create stimuli for investors in the Russian Far East of territories of advanced social and economic development (TOR), in which administrative regulations are eased and there are tax and tariff privileges enabling real growth in the scale of Russo-Chinese cooperation at the level of small and medium-sized firms, change is occurring slowly. Yet, such Russian and Chinese firms note the insufficiency of high-quality information on business conditions in each other’s country, especially on local laws. More often than large state companies, the small and medium-sized firms encounter administrative barriers.

Mutual Trade

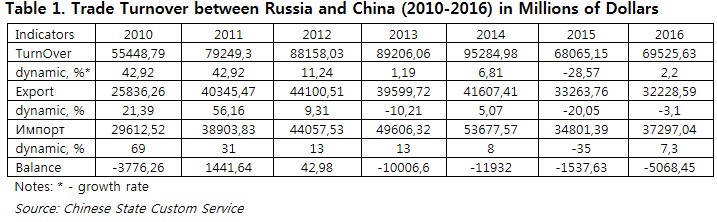

In light of the undeveloped state of more complex forms of economic cooperation, bilateral trade remains its leading form. After a sharp drop in the 2009 crisis, trade turnover rose rapidly in 2010-12, reaching $90 billion. This level held in 2013, and in 2014, it approached the goal of $100 billion, which had been set by leaders of the two countries. However, in 2015, there was a second serious drop over the past decade to $68 billion, as shown in Table 1.

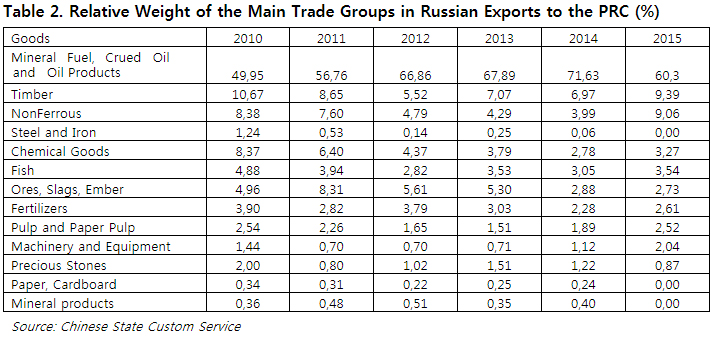

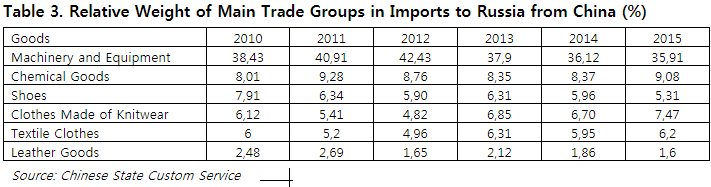

A variety of problems interfering with the development of bilateral trade were already apparent in the preceding years. First, the structure of trade changed unequally, as conditions of slowdown in China’s economic growth and expansion of its own steel production and chemical industry led to a drop in demand for Russia’s traditional exports and left it even more decisively dependent on oil and its price. Beginning in 2013 mineral fuel—oil and petroleum products—comprised more than two-thirds of the value of Russian exports to China, and natural resources more than 80 percent in 2013-14. In contrast, recently in Russian imports from China, goods with high value added have predominated: machines and equipment (since the pre-crisis year 2007 not falling below 30 percent), products of the chemical and light industries (more than 8 and 20 percent respectively of the value of imports from China in 2013-14). As a result of the unbalanced tempo of increase in Russian exports to and imports from China in 2013, as well as of the drop in world prices for oil in 2014, a negative trade balance reappeared. In the opinion of Russian and Chinese experts, the slow change in trade in 2015-16 was due to a variety of objective factors, which first appeared in 2014, and the delayed effect of which was fully seen in 2015.

These factors are the following: first, overall geopolitical tensions, complicated by the situation in Ukraine, the imposition by the Western countries of economic sanctions on Russia, the worsening of the world trade paradigm, including the falling demand in foreign markets, the volatility of the global financial market, and debt problems in the Eurozone and the United States; second, the slowdown in economic growth in both Russia and China; third, the fall in world prices for energy and raw materials; fourth, the drop in Russia of the capacity to purchase Chinese products given the devaluation of the ruble; and fifth, the intensifying pressure beginning in 2014 from the declining trend in Chinese foreign trade, which in 2015 slipped by 8 percent to $3.959 billion—of which exports dropped by 2.8 percent to $2.277 billion and imports by 14.1 percent to $1.682 billion. Negative dynamics were noticeable also in trade with other partners of China, e.g., EU trade dropped 8.2 percent, ASEAN trade 1.7 percent, and Japan trade 10.8 percent, while a 0.6 percent rise was seen in US trade. Following the collapse in oil prices, the ruble weakened sharply (more than 50 percent in relation to the dollar), partly compensating for the fall in the value of energy exports through increased competitiveness of other Russian exports. See Table 2.

In 2015, Russia substantially increased exports of grain to the Chinese market. Previously, China imported only small volumes of high-quality rice and wheat, but now it needed corn, wheat, barley, rice, and soy. There was a rapid rise in Russian supplies of candies, chocolate, sunflower oil, beer, and other foodstuffs. Moreover, Russia succeeded in increasing the share of machines and equipment in its total exports to China from 1 to 2 percent. Russian services, above all tourism from China, became more attractive. At the same time, Russia cut imports from China with the exception of vegetables (+4.2%) and fruits (+5.9%), substituting for products disappearing due to sanctions. However, on the whole, the structure of imports from China was left practically unchanged, See Table 3.

The crisis turned out to be, if not deeper, then more prolonged compared to the prior crisis in 2009, which produced a shock of a fall and then rapid recovery to the point in 2010 of already surpassing the pre-crisis level. Now conditions for rapid recovery are not visible; the level of trade in 2016 was just 2.2 percent higher. Nevertheless, there was a positive dynamic seen also in the first half of 2017. In January-June 2017, trade rose 25.7 percent to $39.778 billion with Russian exports up 29.3 percent to $20.336 billion and imports up 22.2 percent to $19.442 billion, according to Chinese customs statistics. Russia climbed to twelfth among China’s trade partners from 14th in the first half of 2016 at a time of reduced Chinese trade with many key partners and its slower restoration. See Table 4.

While overall Chinese trade in this half-year period grew by 10 percent (imports by 18.9 percent), Russo-Chinese trade grew faster, mainly as a result of tendencies in global markets for raw materials, including oil. Mineral fuels, oil, and oil products accounted for 66 percent of Russian exports, when a year earlier they were 54.5 percent. The physical volume of oil exports rose 11.3 percent, but due to price increases, the rise in value was at 51 percent, to $11.54 billion. In total, energy sources, including coal, diesel fuel, and compressed gas climbed in a similar manner. There was growth also in the export of agricultural products and foodstuffs (4.1%), machine-technical products (8.55), wood products (21%), fish products (17%), and chemical products (86%).

The main reason for an increase in imports of Chinese goods to Russia, according to analysts in Russia and China, was the rise in the value of the ruble and fall in that of the yuan. Chinese goods became more accessible. There was a rapid rise in e-commerce, providing an additional stimulus. In 2016 Russia ranked fourth in the volume of exports of Chinese products online. It hardly pays to count on rapid change in the structure of bilateral trade, even if in 2016-17 there was a noticeably consistent rise in the volume of trade in industry, technology, and high-tech goods and services. In the case of some Russian imports, further increases probably depend on the US and European sanctions regime. In 2016 machine-technical products rose from 2.04 to 2.73 percent of Russian exports to China. In light of already realized and projected joint projects in atomic energy (construction of a second Tianwan nuclear reactor, supply of atomic fuel for the first reactor and for a Chinese experimental reactor with fast neutrons, construction of a reactor with fast neutrons and of a floating nuclear power plant,3 and supply of enriched uranium and isotopes), one can presume further increase in Russian high-tech exports. Besides, there is promise for increased exports of “flying apparatuses” as agreement was reached on transferring helicopter technology and following through on projects to build a heavy civilian helicopter and a wide-fusillage, long-distance airplane. The Russian mid-distance plane “Sukhoi Superjet 100” may be moved into the Chinese market. Under examination is a program of cooperation between the Far Eastern regions of the Russian Federation and the Northeast provinces of China for construction of 19 large, joint Russo-Chinese enterprises for producing wood products, which would serve to boost Russian exports to China.

Although the task of reaching $200 billion in trade by 2020, officially set by the leadership of both countries, still has not been taken off the agenda, many experts predict over the mid-term a modest rate of growth in trade. Realization of the designated targets to a significant degree depends on increases in supplies of oil and gas from Russia to China as well as on the dynamics of world prices for energy resources. Besides oil and gas there exists the possibility of broadening bilateral trade in energy resources by virtue of increases in supplies of Russian coal to the PRC and expansion of the export of electricity (including joint construction of huge hydroelectric stations in the southern part of Siberia.

Consolidation and development of trade cooperation presumes the resolution of several key problems. First, it is necessary more precisely to specify the conditions of bilateral trade in goods and services. Zones of free trade (ZFT) could improve conditions of access for Russian production to the Chinese market. At present China has, in one form or another, ZFT with 22 countries and territories, through which almost 40 percent of its foreign trade passes. Russia is not among them. A ZFT means first of all mutually favorable customs tariffs for the movement of goods. Competition on the Chinese market, taking into consideration the factor of the slowing Chinese economy, will be fierce, in which each percent of customs charges will matter. Actually, this already is the case. In supplying Russian coal to China, tariffs are imposed, but not for coal from Australia and Indonesia. In 2015 an agreement was reached between the Eurasian Economic Union (EEU) and China to begin talks on cooperation, one point of which should be to propose creation of an “EEU-China ZFT.” This project would make concrete the contents of cooperation within the rubric of the Silk Road Economic Belt (SREB), strengthen the integration potential of the EEU, and also raise the significance of this organization in the eyes of Chinese partners.

Second, it is necessary to remove barriers interfering with trade and investment cooperation in the Russian Far East. Considering that in this entire area live just more than 6 million persons, this scale in Chinese understanding is a “second-order city.” At the same time, useful mineral resources are concentrated in the region. In light of the small scale of the internal market and distance from the European part of the country, one cannot count on large investments in processing sectors. For Chinese companies, extraction and processing of raw materials, maritime bio-resources, the development of transport corridors, and agriculture could draw interest. However, for that possessing developed inter-urban infrastructure is essential. At present on the Russo-Chinese border, there is not even one bridge crossing the Amur amd Ussuri rivers. Two projects—bridges between Dongjiang and Nizhne-Leninskoe (Jewish autonomous oblast’) and Heihe and Blagoveshchensk (Amurskaia oblast’)—have still not been completed, despite inter-goverment agreements in 2007 and 1994 respectively.

Third, considering that the energy market has long been a buyer’s market in spite of all the fluctuations in the price of oil and gas, Russia must fully meet on time the obligations in the gas contract of 2014 and begin delivery of gas to China in 2018. The coming 2-3 years will, to a large degree, be decisive from the point of view of the long-term perspective of Russo-Chinese economic cooperation. Doubt cannot be put aside that it will not overcome the current phalanx of difficulties. Yet, there is possible promise of realizing a model of economic cooperation that would facilitate stable co-development of the two economies rather than prolong the forces of inertia, where economic ties are just a supplement to political relations. The choice between these possibilities is not obvious. It should be kept in mind that a third undesirable but hypothetically probable variant exists, when military-political circumstances stop limiting any increase in the economic distance between the countries.

Mutual Investments and Joint Projects

Hopes for investment cooperation becoming the locomotive of accelerated development of bilateral economic interactions were unrealized. After the financial crisis of 2008, China introduced its strategy of “going out to the world,” which mainly consisted of stimulating investments by Chinese firms abroad. But this powerful flow left Russia aside. Although leaders of the two countries frequently draw attention to the low level of mutual investments and insist on the need to change this, results remain slim. As before, Russia is not among the top ten recipients of Chinese investment, lagging even behind Kazakhstan. In 2010-13 when the average level of direct foreign investment in the Russian economy was $52.5 billion a year, China’s share hovered at 1.3-1.6 percent, rising only in 2014 when there was a sharp dropoff in overall FDI. In 2016 the figure was 2.9 percent, as seen in Table 5. In accord with the intentions of the leaders of Russia and China, by 2020 the accumulated Chinese FDI in Russia’s economy shoul rise to $12 billion. But this would mean, should FDI in Russia be restored to the 2014 level, that the flow of Chinese investment would actually drop to 2.7 percent.

Comparison of investment flows between Russia and China show that Russian hopes for deepening economic cooperation on this basis have not been realized. The accumulated Russian direct investment in China’s economy as of 2016 was just 1/10th that of Chinese direct investment in Russia ($917 million vs. $9.5 billion). Chinese investments were made almost exclusively by large state companies and «political» financial institutions, which often insure against possible risks by signing corresponding inter-governmental agreements. Investments are directed primarily at spheres that enable acces to natural resources necessary to China (energy, wood processing), land resources, and increases in employment (agricultur, construction and production of building materials, trade, light and textile industry, ans services). Russian investments are directed toward businesses, which enable access by Russian companies to China and mainly facilitate trade and fulfillment of contracts (construction and transport deliveries).

The SREB and EEU

Discussions about participation in Belt and Road Initiative (BRI) have become an important part of bilateral relations with China of practically all states of Eurasia. In 2016, China’s ambassador Li Hui declared that Russia, as the largest neighbor and strategic partner of China, is an important participant in the construction of the Silk Road, having some real advantages in this.4 In 2016 and the beginning of 2017, the pathway for drawing the EEU and SREB, as announced by the leaders of Russia and China in 2015, continued to be one of the main themes in the mass media, in official discussions, and in the community of experts.5

Among the priority tasks of drawing together is cooperation in creating a whole array of ZFT, stimulation of investments, simplification of trade procedures, and construction of trans-border parks. In the opinion of experts, differences exist in the priorities of the two sides in drawing the EEU and SREB together. China prioritizes simplifying the trade and investment regime between the two countries, while the EEU apparently looks to three main vectors: construction of new and modernization of old transport corridors in Eurasia; completion of an all-encompassing agreement on trade and economic cooperation between the EEU and China; and formation of a «road map» including concrete projects and measures for reconciling the economic interests of the two.6 One can distinguish no fewer than six transport routes within the scope of SREB of interest to the countries of the EEU: 1) the planned RF-PRC high-speed railroad corridor “Beijing-Moscow”; 2) the “China-Mongolia-Russia” corridor; 3) the “China-Central Asia-West Asia” route; 4) the “China-Indochina” route; the “China-Pakistan” route; and 6) a “Bangladesh-China-India-Myanmar” route.

Although Russian and Chinese specialists are split over other logistical schemes,7 the overall directions of their proposals overlap since the assumed network is concentrated in the PRC: 东稳北强南下西进, or to stablize to the east, to strengthen to the north, to go down to the south, and to proceed to the east is the doctrine that can be seen as China’s long-term strategy for transport exits beyond its borders, which is being actively realized by Xi Jinping. Most relevant for Moscow is “to strengthen to the north,” which expresses Beijing’s desire to forge in Russia transport-logistical centers and invest in infrastructure projects that serve Russian interests.

On June 25, 2016, the two sides signed a joint statement to launch a negotiating process to prepare an overarching agreement on trade and economic cooperation of the EEU and the PRC.8 The main sections include tariff, tecnical, sanitary, veterinarian, and phytosanitary regulations, defense of intellectual property and competition, and e-trade. They plan to establish an “institute of complex cooperation.” In agriculture, industry, energy, transport, communications, and infrastructure should be shaped in “common formats through projects of common interest.”9 Talks between the two sides are proceeding at an intensified tempo, according to T. Sarkisiana, chairman of the Eurasian Economic Commission board. After the agreemeny for a common approach to drawing the EEU and SREP together in August 2016 in Beijing the first round of talks took place, followed by meetings of a working group under Minister V. Nikishina.10 Seen as a first step is reaching a non-preferential agreement to simplify trade and regulatory issues, which is thought possible witin two years, as was repeated at the beginning of October 2017.

Besides talks on trade-economic cooperation, which discuss questions within the purview of the EEC, the Russian side proposes to launch one more track on the regulation of non-tariff measures, but the governments of the states in the EEU have not delegated to the EEC full authority to discuss these questions. Russia is ready to conduct talks within the scope of preparations for an agreement on trade and economic cooperation on taking steps for tariff regulation, which should be completed with the establisment of a ZFT, perhaps in 2030-35.

The Chinese side views the EEU as in the stage of formation: if its members reached agreement on key questions of trade in goods, in the sphere of investments no unified rules have been formulated. Agreements with the EEU on an investment regime pose difficulties for China tied to the different levels of openness of its members to external investments. Similar difficulties remain for a trade regime. The EEC prioritizes large projects, but to realize them effectively, institutional guarantees are necessary as well as removal of trade and investment barriers. Especially the lack of effectiveness and of transparency in procedures for border control act as an obstacle to the movement of regional trade and increases in the flow of investments. In EEU, states’ preparation of foreign trade documentation and observance of procedures of border control take a lot of time and expense. The priority in cooperation should be simplification of tariffs, quarantine and inspection procedures, development of trans-border transfers, and e-commerce. The WTO agreement on simplification of trade procedures could serve as the basis for cooperation between China and the EEU in this direction. The establishment of ZFT would make it possible to resolve this problem and lower non-tariff barriers, giving positive results not only to Chinese companies, but to firms of the EEU states from exports to China.

In developing cooperation between China and the EEU states, Chinese experts suggest relying on the negotiating experience of China with ASEAN and the EU on matters of trade and investment regimes and rules. The main theme in China-ASEAN talks was agreement on the establishment of ZFTs. Relations of all-around partnership with the EU include talks on a bilateral investment agreement and working out a technical-economic foundation for forging ZFTs between China and the EU. The two sides expressed their priority directions for cooperation, agreed on mechanisms and principles for cooperation, and are discussing and realizing concrete projects on the bilateral level. A similar work plan would bring positive results and could be considered in drawing together the EEU and SREB.

As for forging a “road map,” including concrete projects and measures to narrow the gap in economic interests of the EEU and China, its main source will be the medium- and long-term plans for economic development of the participating states. At the same time, states would do well to put forward an overall plan for drawing together and, as quickly as possible, introduce an operating program of action, as Russia and China establish trans-national research groups and develop academic exchanges and joint research to provide needed expert support. On August 24, 2016 at a meeting of Sarkisiana with Vice Premier Zhang Gaoli a Chinese initiative was approved for creating a bank of data for planning and acting on projects of the PRC with the EEU countries, which are participating in the process of drawing the EEU and SREB together, and work on this has already begun. In March 2017, the EEC announced the completion of a list of priority infrastructure projects to be realized on the territory of the EEU and “support the formation” of SREB.

China and the member states of the EEU have already established a stable system of bilateral contacts, in which, within the scope of building SREB, states are drawing together their national development projects, as in the Kazakh program “path to the future” and the Sino-Kazakh program of industrial-investment cooperation. China does not think it should be included in projects already on their way to realization, mixing coordination processes on the regional and bilateral levels. There should be concentraion on sectors where there the EEU has already reached a shared consensus. This would create a more synergistic effect; however, it could not give full support to Russia, while taking into account the national interests all members of the EEU. Thus, Russia and China consider the convergence of the EEU and SREB not at all to be the only format of cooperation in creating new conditions for stable development of Eurasia. Realization of the proposed Russian initiative for a Greater Eurasian partnership can facilitate development of the region.

Russo-Chinese Cooperation in the SREB Project

China is interested in ensuring the security and durability of the “routes,” understanding that this can be guaranteed only by the stability of the situation across the extent of the “belt,” through which this route passes, avoiding destabilizing geopolitical tensions. For that reason, it places such a strong emphasis on “mutual benefit” and “joint development.” Military bases, historical memory, and geopoloitical games are not in a position to provide for long-term stability in relations, which can be done only through long-term economic interests based on reliable rents and returns on investments.

Of course, China understands that it should take into account Russia’s interests, but it resolves only its own problems. These are serious problems. First, at this stage of economic development it is necessary to transition into an intensive dynamic in bordering and southern regions, which could utilize secure transport corridors, above all the maritime silk route since the main markets are in the United States and Europe. Yet, the second, equally important problem is the possible exploitation of the potential in western and northeastern provinces, which also requires a reliable transport corridor, for which land routes are available.

In resolving these problems, China should make sure to strengthen its control in Central Asia and avoid likely conflicts of interest with Russia—situations that Chinese themselves obviously recognize.11 First, in doubt over its influence over the political and economic processes in the states from the former USSR, Russia is very sensitive to anyone else’s influence. Second, the new routes could undercut the force of and the expectations for Eurasian transit through Russian territory on the Trans-Siberian and BAM railroads. Of course, there is no real possibility to stand opposed, and simply to compete with China in supplying trans-Eurasian transit is beyond Russia’s means. It is also nearly impossible to compete with China in oreserving exclusive political-economic control over the Central Asian sub-region.

Russia remains one of the main players in the economy—primaily the resource sector—of this region, but China has continuously and successfully strengthened its position in recent decades. By 2013, China’s imports of raw materials from Central Asian states exceeded $22 billion. Chinese companies control roughly 25 percent of the extracted oil in Kazakhstan (about 20 million tons), paying more than $23 billion to purchase oil stocks from Western firms. In Turkmenistan, China received $12 billion in credits for boosting production and export of exclusive gas rights. And this cooperation will grow, as pipeline infrastructure expands (coming for 20 million tons of Kazakh oil and a gas line from Turkmenistan for 55 billion cubic meters. China’s interests extend to metals, imports of which in 2014 exceeded $2.7 billion in value, especially from Kazakhstan, which supplies 98 percent and 75 percent of uranium imports, which makes relations for China as it plans to increase its nuclear reactors from 31 in 2015 to 110 in 2030.12

China is replacing Russia as the main trading partner for the governments of Central Asia, raising its trade with them in 2013 to more than $50 billion ($18 billion more than Russia), while supplying goods with higher value added (machines, light, and electronic industry) and increasing the technological dependence of the region on China. It is drawing closer to the countries of Central Asia in regard to technology, infrastructure, and finance, which cannot but generate competitive effects in its relations with Russia. And the SREB concept, forging new infrastructure, technological, and financial-economic forms of cooperation, cannot but intensify this competition.

There is, however, one more wide-ranging sore point connected to this project. China’s accent on Central Asia and the southern trans-Eurasian corridor thratens to devalue the far eastern vector of Russia’s eastern policy, the central idea of which is the construction of a regional “docking station” with the countries of Central Asia and, first of all, with China. Indeed, with projects tied to this model are vast means invested and planned (oil and gas pipelines, energy-generating and networking systems, modernization of ports, railway and highway construction, etc.).

Memories exist in Russia of the threat of geoeconomic competition, but there are few actual measures to allay the threat posed by Chinese economic expansion. The political declaration of 2015 on drawing together the projects of Eurasian integration and SREB—in which the joint integration of BRI and the EEU was declared by strengthening cooperation in technology, transport, infrastructure, and development of the Russian Far East13—demonstrates mutual awareness of the threat that geoeconomic competition would transform into geopolitical confrontation. However, there are still no mechanisms to defend Russian interests within the scope of joint investment projects in general and the BRI in particular, which will not automatically turn into a panacea from economic misfortunes or guarantee national interests.

Conclusion

In the 1990s, Russia already hoped in vain that becoming an economic satellite of the Atlantic world would automatically bring prosperity and social peace, building a “new economy” of a post-industrial type. Now no longer the liberal-globalists, but fully respectable state-nationalists explain that being an econpmic satellite is very good since China is not the West, but the East, which, of course, is an entirely different matter, bringing all the good fortune that proved to be a source of friction in the case of the Western orientation.

Of course, it is not worthwhile in place of compromises to seek confrontation and spoil everything in a clearly losing confrontation, but economic compromise means thinking and acting rationally. It is wrong to insist on only one map, East or West both are needed to participate in global projects, in each of which one must look for and firmly insist on one’s own national interest, creating maximum economic freedom for a rapid rise in economic potential and incomes. Only a strong internal economy can guarantee national comfort and assured competitive positions globally. Needed for Russia to restore its economy are not magical recipes or geographical preferences or inclusion of it in a world of megaprojects, but the ability to motivate and mechanisms to guarantee massive investments in the creation of real products and services, generating actual demand and, correspondingly, rising incomes for business, households, and, in the final count, the national budget.

1. Василий Кашин, “Промышленная кооперация – путь к сопряжению российской и китайской экономик,” 18 апреля 2016, http://www.globalaffairs.ru/valday/Promyshlennaya-kooperatciya–put-k-sopryazheniyu-rossiiskoi-i-kitaiskoi- ekonomik-18110

2. Warm relations between leaders do not guarantee that contracts will be signed. Business representatives can talk for years, and then not reach a deal, as happened in 2016 between Rusgidro and China Three Gorges Corporation.

3. This is written in corresponding agreements and memoranda.

4. “Китай считает Россию важным участником проекта нового Шелкового пути,” January 19, 2016, https://www.ria.ru/worid/20160119/1361667155.html

5. “Joint Declaration of RF and PRC on Drawing Together Construction of SREB and the EEU from May 8, 2015,” http://www.kremlin.ru/suppement/4969

6. I. Zubkov, “Budet kak Shelkovyi,” Rossiiskaya Gazeta, December 5, 2016, https://www.rg.ru/2016/12/05/zhunusov-pekin-vsegda-delaet-stavku-na-ekonomicheskuiu-celesoobraznost.html;

Бизнес-диалог с предпринимательским сообществом государств – членов Евразийского экономического союза // Официальный сайт Евразийской экономической комиссии,

http://www.eurasiancommission.org/ru/act/trade/catr/interaction/business_dialogue/Pages/defaJt.aspx

7. S.G. Luzianin, S.L. Sazonov, «Ekonomicheskii poias Shel’kovogo puti: model’ 2015 goda," Obozrevatel’, No. 5, 2015, pp. 40-43.

8. “Председатель Коллегии ЕЭК дал эксклюзивное интервью ТАСС по итогам визита в Китай,” August 25, 2016, http://www.eurasiancommission.org/ru/nae/news/Pages/25-08-2016-1.aspx

9. “Словесные инвестиции: Сотрудничество РФ и КНР расширяется, не ускоряясь,” June 27, 2016, http://www.kommersant.ru/doc/3023535

10. “Председатель Коллегии ЕЭК дал эксклюзивное интервью ТАСС по итогам визита в Китай,” August 25, 2016.

11. Han Lihua, “Evraziiskii vyzov,” Upravlencheskoe Konsul’tirovanie, No. 11, 2016.

12. D.S. Popov, “Central Asia in the Chinese Conception of the Silk Road Economic Belt and the Strategic Interests of Russia,” https://riss.ru/analitycs/30016/

13. Statement at the St. Petersburg international economic forum, 2016.

Print

Print Email

Email Share

Share Facebook

Facebook Twitter

Twitter LinkedIn

LinkedIn